BOISE, Idaho — The Idaho Senate Local Government and Taxation committee voted along party lines Thursday evening to advance House Bill 436 to the full Senate floor.

The Republican-backed bill has moved quickly though the statehouse and looks to provide $600 million of income tax relief.

Although Democrats agree with providing tax relief via the $1.9 million state surplus, they disagree with how it should be done. Democrats have called HB 436 a lopsided bill that most benefits the wealthy; however, Republican bill sponsors have defended their bill as is.

"We would take anything over House Bill 436," Minority House Leader Rep. Ilana Rubel said. "Any configuration of policy you could choose that would be more equitable and reasonable than what's being put forth."

Democratic House and Senate leaders held a media briefing Thursday to only voice their opposition to HB 436 and propose alternative tax relief options.

"There's no other option out there and we're being told this it, and that's so wrong on so many levels," Democratic State Senator Janie Ward-Engelking said.

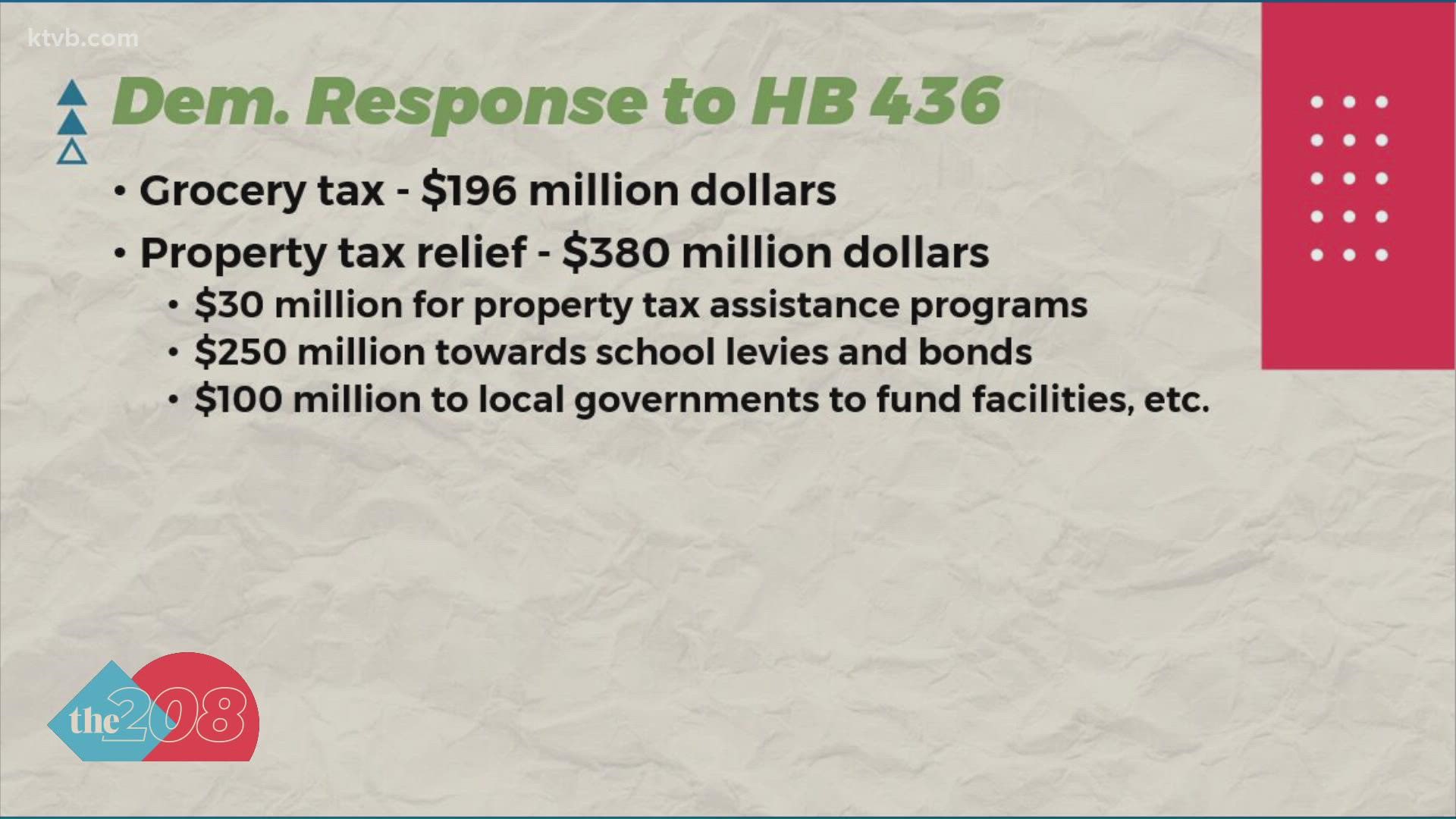

The Democrats proposed $196 million to repeal the sales tax on groceries and an additional $380 million worth of investments that will ease property tax burdens, according to Rep. Rubel.

Breaking down the $380 million investments; Democrats propose $30 million to more than double property tax assistance programs, $250 million to pay down school levy and bonds, and giving $100 million to local governments for facility upgrades and needs. These investments will result in lower property taxes, according to Rubel.

"We thought it was really important because this is a $600 million cut and it is historic, and it's not something we get a second bite of the apple on," Rubel said. "We don't get to spend $600 million again, or at least we don't get to take that kind of revenue reduction again, while still having any hope of funding infrastructure in schools and all the other things we want to target. And so we need to get this right, and House Bill 436 does not get it right."

Democrats have criticized HB 436, citing Idahoans prefer sales and property tax cuts more than income tax cuts. However, Idahoans prefer income tax relief at a far higher rate than sales tax relief, according to Boise State University's seventh annual Idaho Public Policy Survey.

The survey found Idahoans prioritize income tax cuts and property tax cuts at near similar rates.

Watch more Idaho politics:

See all of our latest political coverage in our YouTube playlist: