SPOKANE, Wash. — There have been two new political ads released ahead of the Nov. 6 election: one from Rep. Cathy McMorris Rodgers campaign and one from Lisa Brown’s campaign.

KREM did a breakdown of the latest spots from both candidates.

McMorris Rodgers: Lisa Brown was driving an income tax pitch

"Here's what news outlets have to say about Lisa Brown on taxes. The Seattle Times says that Lisa Brown was driving an income tax pitch," the Cathy McMorris Rodgers spot said.

That is in fact what the Seattle Times article said. In 2009, when Brown was a leader in the state senate, she floated an income tax idea.

There are two things to note: One, it was only an idea; she never formally proposed anything.

Two, the idea wasn't a full income tax scheme. It would have only applied to people earning $250,000 a year or more.

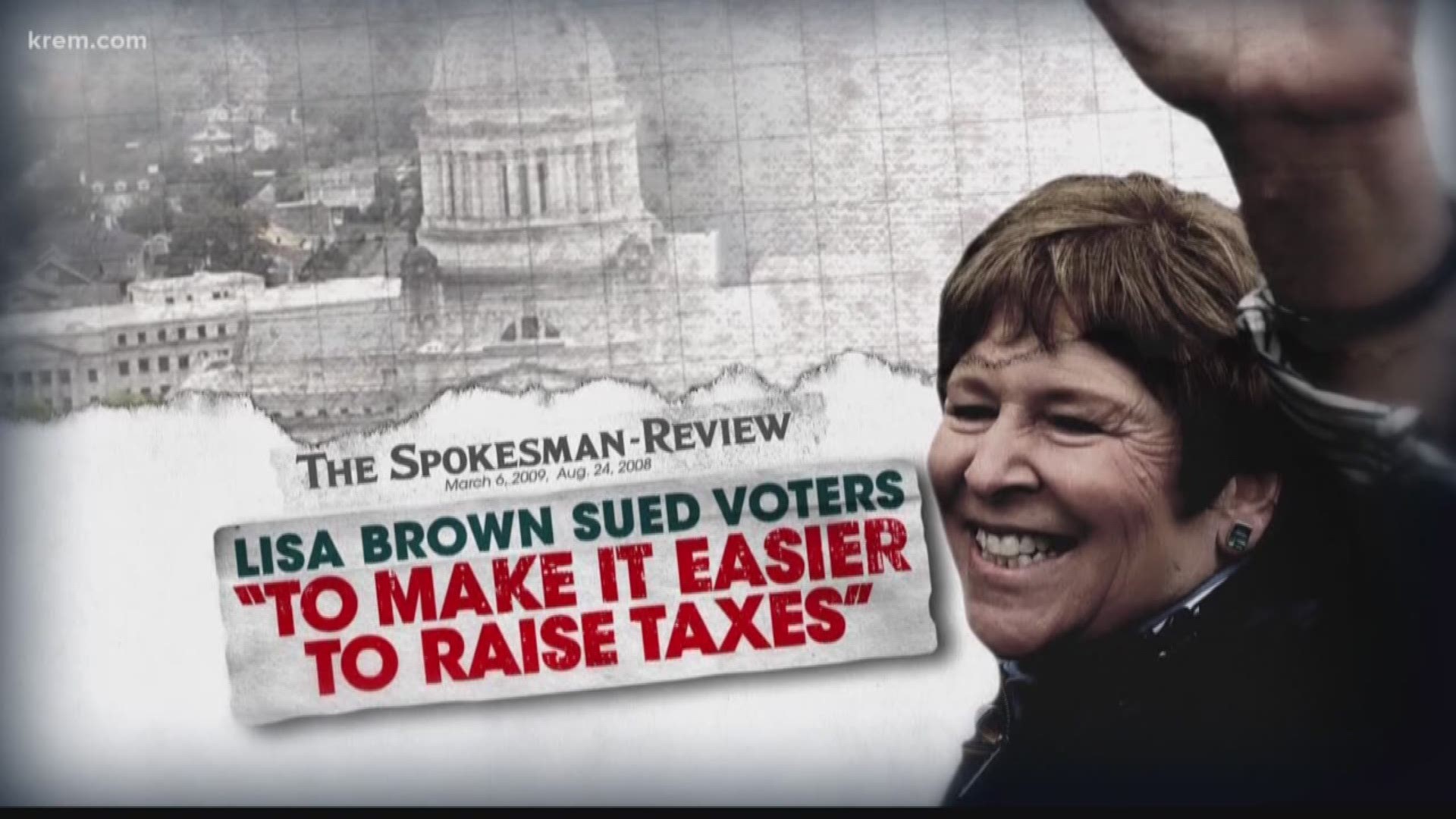

McMorris Rodgers: Lisa Brown wants to make it easier to raise taxes

"The Spokesman Review said that Lisa Brown went to court to make it easier to raise taxes," the McMorris Rodgers ad said.

Anyone who's lived in Washington for a while remembers that, for a long time, all tax increases required a two-thirds super majority in the legislature or a statewide vote.

And it is true that Brown went to court, claiming that requirement was unconstitutional.

But it's worth remembering, while her initial suit was dismissed, she won that argument. The state Supreme Court, in a later case, found the law violated the state constitution.

Now on to Lisa Brown’s ad.

"It's been negative attack after negative attack from Cathy McMorris Rodgers," the Brown ad said.

There have been a lot of negative ads in this race. But, this ad itself is negative, so make of that what you will.

Lisa Brown: Brown never voted to raise tuition, despite McMorris Rodgers claims

"With desperate claims the Associated Press calls inaccurate."

The AP fact-checked McMorris Rodgers’ claims that Lisa Brown voted to raise tuition. And it is inaccurate to say there was any one vote that raised tuition, but that's not the whole story as you’ll see below.

"College tuition is set by the board of regents, not the legislature. Lisa has never been on the board," the Brown ad said.

Those claims are both fully true. Brown was never on the board and never voted outright to raise tuition.

But as a leader in the legislature, Brown voted to lift the cap on tuition hikes. Meaning, she voted to let the board raise tuition, if they wanted, and that's exactly what they did.

Brown: McMorris Rodgers voted for student loan rate hikes, grant cuts, financial aid taxes

"She voted to raise interest rates on student loans, cut Pell Grants, and tax student financial aid."

Here’s how those three claims check out.

First: raising interest rates on student loans. That vote, in the immediate term, actually lowered rates. But, in the long term, it raised the cap on how high rates can go. It also tied those rates to the value of a treasury bond, meaning the rates can fluctuate more, whereas previously the rates were flat. That's why the bill was opposed by some Democrats, though it was passed and signed by President Obama.

Second: cutting Pell Grants. This one's true. In 2015 the maximum Pell Grant was $5,820.

A budget proposal McMorris Rodgers voted for suggested changing that to $5,775, however, that proposal was not in the final budget.

Third: taxing student financial aid. The initial GOP tax plan last year revoked a number of deductions and credits, including those for student loans. However, the deduction on student loan interest rates was restored in the final bill.

The ballots are coming out soon, and KREM will be staying on top of all the races and facts.

CORRECTION: A previous version of this article stated that Lisa Brown won her suit against the two-thirds requirement. In fact, although the Supreme Court eventually threw out the requirement, Brown’s specific suit was dismissed. The story also failed to note that the final 2017 tax law restored the student loan interest rate deduction. It has been updated to include those facts.