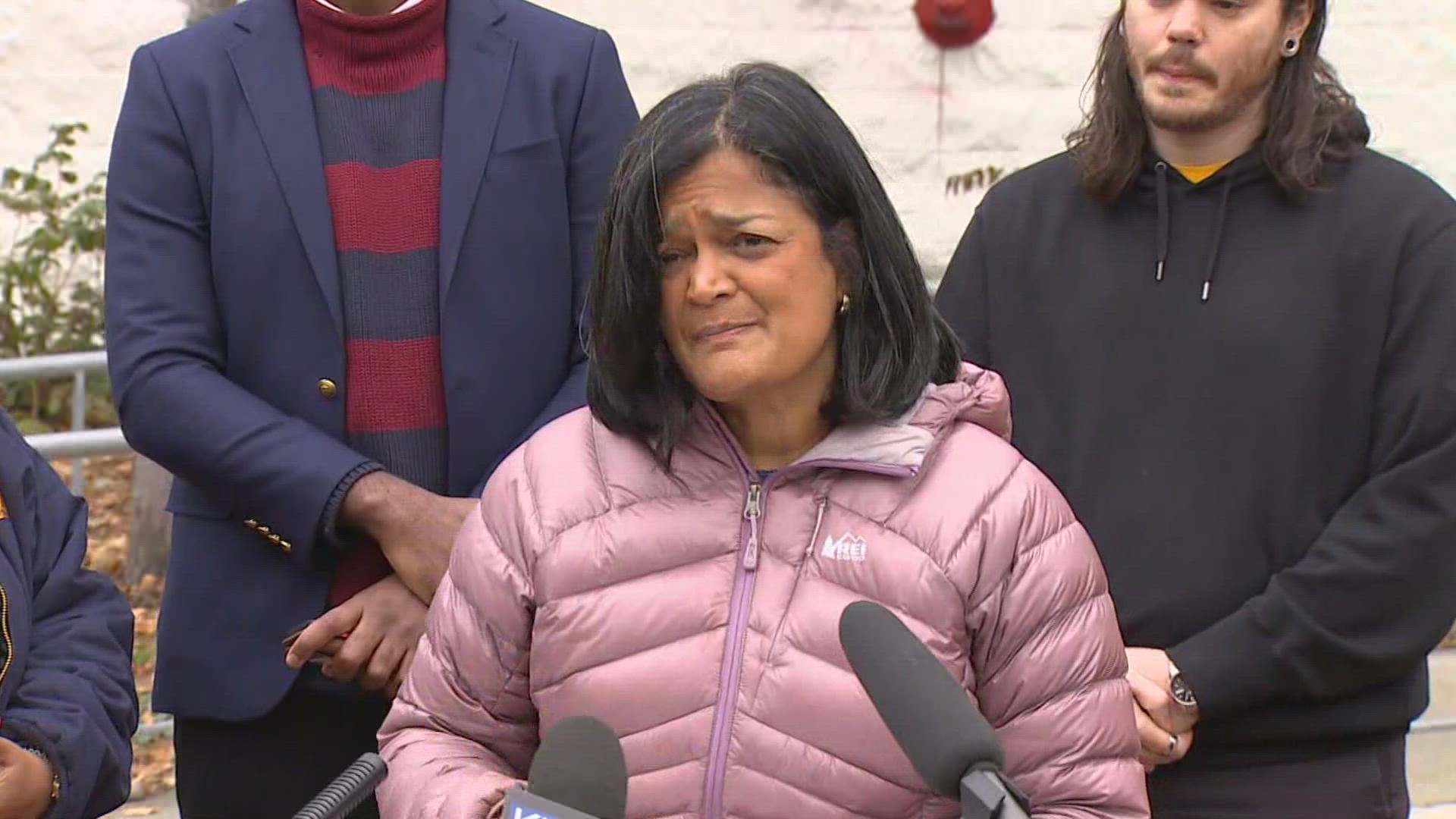

WASHINGTON — U.S. Rep. Pramila Jayapal (WA-07) is calling on the Federal Trade Commission (FTC) to closely investigate Kroger's proposed acquisition of Albertsons.

Jayapal said the proposed acquisition would threaten competition and hurt consumers, workers, and small businesses. It presents several anti-competitive concerns, including fewer product choices and higher costs, she said in a release.

Jayapal and U.S. Rep. Adam Smith, who represents King and Pierce counties, were among four members of Congress to sign a letter to the FTC on Nov. 21.

This comes after two of the nation's largest grocers agreed to merge on Oct. 14 in a deal they say would help them better compete with Walmart, Amazon and other major companies that have stepped into the grocery business.

The more than $20 billion deal would allow Kroger, which owns Fred Meyer and QFC stores, to acquire Albertsons, which owns Safeway stores. The deal is expected to close in early 2024 if it's approved by the FTC, the Department of Justice and survives any court challenges.

Kroger Chairman and CEO Rodney McMullen, who would retain those titles at the combined company, said the combination could save $1 billion annually in lower administrative costs, more efficient manufacturing and distribution, and shared investments in technology. He said the company would plow those savings back into lower prices, higher wages and improved stores.

“We will take the learnings from each company to bring greater value and a better experience to more customers, more associates, and more communities," McMullen said in a conference call with investors.

A King County judge granted a temporary restraining order blocking Albertsons from making a $4 billion dividend payment to investors on Nov. 3.

Washington State Attorney General Bob Ferguson sued on Oct. 28 to stop the payment while Albertsons' merger with Kroger Co. is under review, saying it could jeopardize the company's ability to do business and threaten jobs.

According to Securities & Exchange Commission filings, the $4 billion payment exceeds Albertson's cash on hand, Ferguson said.

A spokesperson responded to the lawsuit, calling it "meritless" and saying the dividend payout is not contingent on the buyout with Kroger and will not hurt the company's ability to compete in the marketplace.

"Given our financial strength and positive business outlook, we are confident that we will maintain our strong financial position as we work toward the closing of the merger," the spokesperson said in part. "Additionally, payment of the special dividend will not hinder Albertsons Cos.’ ability to continue investing in our stores and technology to provide an even better shopping experience while we continue to operate as an independent company, and it will not impact the agreements that we have made with unions representing our associates to increase wages and benefits."

The company said it would seek to overturn the ruling as soon as possible.

The attorneys general said it’s unclear if the deal will be approved because federal and state laws forbid mergers that substantially lessen competition. Together, Albertsons and Cincinnati-based Kroger would control around 13% of the U.S. grocery market.

Faye Guenther is president of United Food and Commercial Workers 3000, a union that represents 26,000 grocery store workers. She expressed concern over the potential merger.

"We were surprised by the announcement and came out very quickly in opposition to the merger,” Guenther said. "If you have a Safeway, right across the street from Kroger, which of those stores will be closed? I don't know the answer to that. But the threat is it will either be divested or closed."

Kroger and Albertsons have more than 710,000 employees in nearly 5,000 stores across the country combined.

The merger announcement states that as part of the deal, Albertsons will pay a special cash dividend of up to $4 billion in November to shareholders.

A statement from an Albertsons Companies' spokesperson says, in part: "The special dividend allows us to return cash to all of Albertsons Companies' shareholders. Following the dividend payment, Albertsons Cos. will continue to be well capitalized with a low debt profile and strong free cash flow."

"Four billion should be invested back into the grocery stores to make sure that consumer prices come down, that workers' pensions are safe, that people have good jobs,” Guenther said.

The letter also notes that grocery prices rose more than 12% from last summer to this summer, the biggest jump in more than 40 years.

Guenther said that's another reason why she opposes the merger. She worries it would result in higher prices.

“Having a strong Albertsons and having a strong Kroger, those are both good things for consumers,” Guenther said.