BOISE, Idaho — Idaho will receive about $843,000 from Intuit, the owner of TurboTax, as part of a nationwide settlement to allegations that the company deceived people into paying for tax services that should have been free.

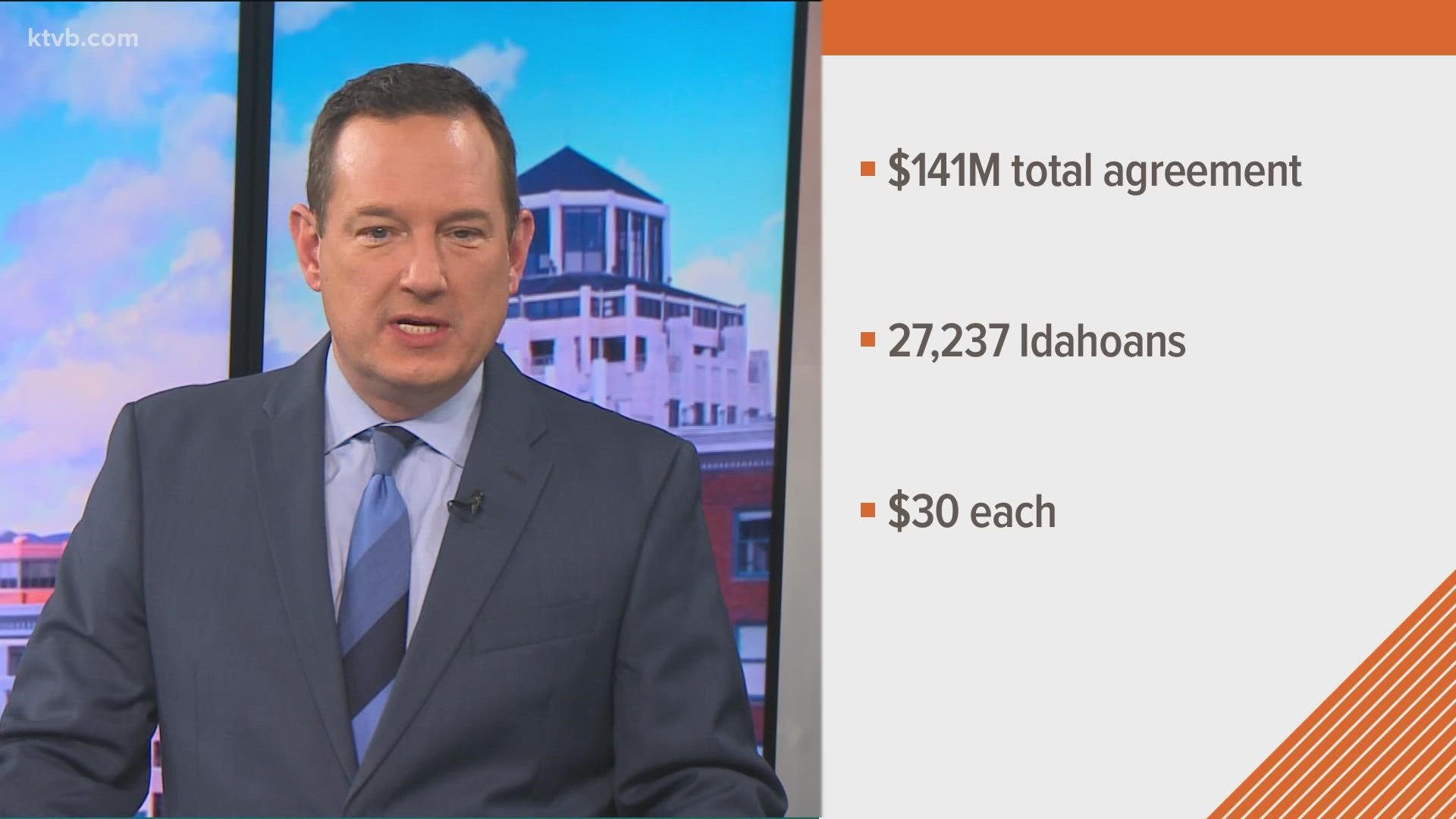

Intuit will pay a total of $141 million in restitution as part of the agreement with all 50 states and the District of Columbia. Payments will go to those who started using TurboTax's Free Edition for tax years 2016 through 2018 and were told that they had to pay to file even though they were eligible to file for free.

The office of Idaho Attorney General Lawrence Wasden said Wednesday that 27,327 Idaho customers will receive checks for about $30 each, for each year they were deceived into paying for filing services. Those affected will automatically receive notices and a check by mail.

"Intuit tricked thousands of Idahoans into paying for services that should have been free," Wasden said in a news release about the agreement. "But the company got caught and this settlement now forces it to pay for its misdeeds. I'm very pleased with this result for those affected."

In addition to the payments, Intuit must suspend TurboTax's "free, free, free" ad campaign that lured customers with promises of free tax preparation services, only to deceive them into paying for services.

The settlement also requires the following from Intuit:

- Enhancing disclosures in its advertising and marketing of free products.

- Designing its products to better inform users whether they will be eligible to file their taxes for free.

- Refraining from requiring users to start their tax filing over if they exit one of Intuit's paid products to use a free product instead.

An investigation into Intuit began after ProPublica reported that the company was using deceptive digital tactics to steer low-income filers toward its commercial products and away from federally-supported free tax services.

Intuit has offered two free versions of TurboTax. One was through its participation in the IRS Free File Program, a public-private partnership with the Internal Revenue Service that allows taxpayers earning roughly $34,000 and members of the military to file their taxes for free. In exchange for participating in the program, the IRS agreed not to compete with Intuit and other tax-prep companies by providing its own electronic tax preparation and filing services.

The second option offered by Intuit is a commercial product called "TurboTax Free Edition." Wasden's office referred to it as a "freemium" product. It is only free for taxpayers with "simple returns" as defined by Intuit. However, that product is only free for about one-third of U.S. taxpayers. In contrast, the IRS Free File product was free for 70 percent of taxpayers.

The multistate investigation found that Intuit used confusingly similar names for both its IRS Free File product and its commercial product. Intuit bid on paid search advertisements to direct consumers who were looking for the IRS Free File product to the TurboTax "freemium" product instead. The investigation also found that Intuit purposefully blocked its IRS Free File landing page from search engine results during the 2019 tax filing season, effectively shutting out eligible taxpayers from filing their taxes for free. Also, TurboTax's website included a "Products and Pricing" page that stated it would "recommend the right tax solution," but never displayed or recommended the IRS Free File program, even when filers were eligible for the free product.

Watch more Local News:

See the latest news from around the Treasure Valley and the Gem State in our YouTube playlist: